2015 was a huge year for CEF’s matched savings program, assisting Members to save towards their personal goals of moving out of the shelter, building an emergency fund, purchasing personal transportation, and much, much more.

This year, after almost two years of research, design, Member feedback, coordination with experts in the field, and finally, some serious database programming, we published the new and improved CEF Safe Savings Account design. Safe Savings Accounts are goal-oriented accounts. Members have limited access to withdrawals of their savings until they reach their goals with CEF, and once they achieve their goal CEF matches their accomplishments at 10 percent!

We launched the program in 2010, and since then Members have saved over $500,000 towards their personal savings goals (amazing!). While many Members have made incredible progress towards

their goals, we set out to improve the overall number and portion of Members who achieve 100% of their goals. Moreover, we set out with a new objective to intentionally build opportunities for Members to create positive, long-term savings habits.

To bring these goals into reality, we partnered with locally based and nationally acclaimed expert on the topic — the Center for Advanced Hindsight at Duke University. The Center for Advanced Hindsight grounded their recommendations to CEF in behavioral economics research.

In partnership with the Center for Advanced Hindsight, we made significant improvements to the design of our program to better assist CEF Members in setting and achieving savings goals. By combining their technical assistance with in-depth feedback from current CEF Members, we made exciting changes to CEF Safe Savings Accounts, including:

- A personal budget-building system that helps Members create detailed, actionable savings plans

- Automated text message and email reminders for scheduled deposits

- An emphasis on setting iterative savings goals, each attainable within six months

- New incentives to encourage more frequent and consistent deposits

And all of these improvements were made in a beautifully redesigned online portal that is easy-to-use and streamlined — making the process of setting and attaining savings goals as painless as possible!

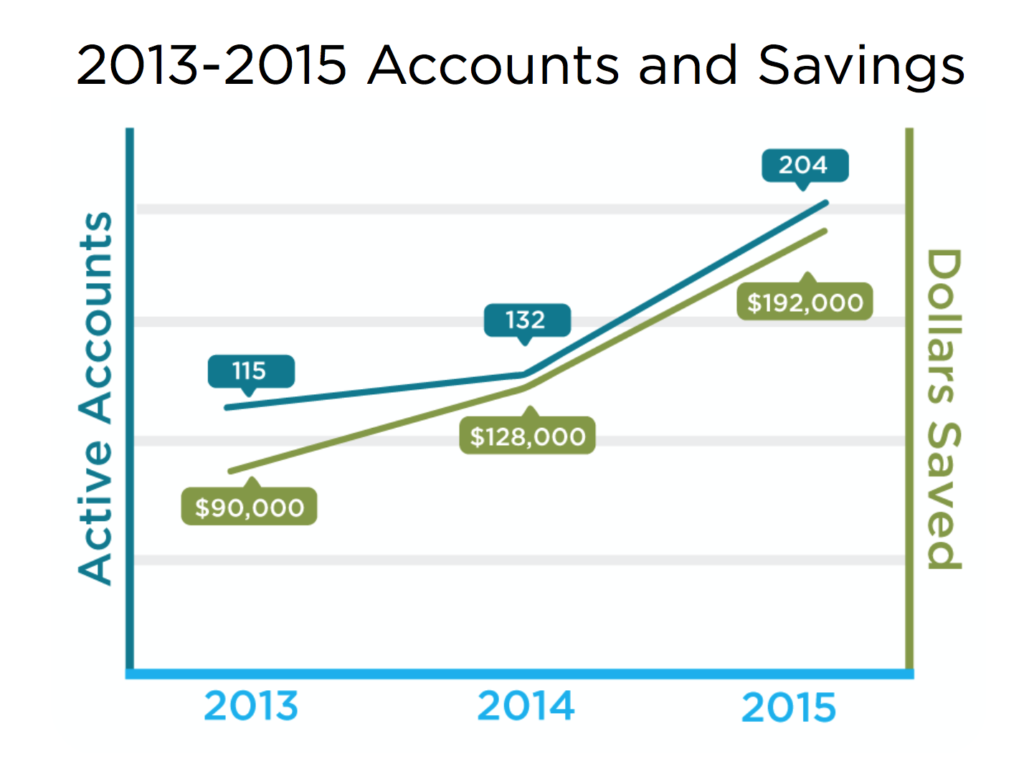

Based on the Center for Advanced Hindsight’s nationally recognized research, these changes will assist CEF Members in achieving the savings goals they set out to reach. For a preview of great things to come, check out the chart below to see the continuing increase in the number of active savings accounts managed by CEF and the total amount CEF Members saved in their accounts annually, which has doubled in just two years!

Based on the Center for Advanced Hindsight’s nationally recognized research, these changes will assist CEF Members in achieving the savings goals they set out to reach. For a preview of great things to come, check out the chart below to see the continuing increase in the number of active savings accounts managed by CEF and the total amount CEF Members saved in their accounts annually, which has doubled in just two years!

As we are always learning and charting new territory with our unique financial services, we are excited to continue our partnership with the Center for Advanced Hindsight in 2016 as they conduct a formal research trial. Stay tuned!

No comments yet.