What is the racial wealth gap and how has it continued?

In 2015, a study found that white households in Boston had a median net worth of $247,500 while Black households had a median net worth of $8. Yes, you read that correctly, $8 (Adams & Brancaccio, 2020). This gap in wealth is not just in Boston. A survey of the U.S. found that white* households’ median net worth was 10 times greater than that of Black households (Cilluffo & Kochhar, 2017). Without action, the worth of Black households is expected to fall to zero by 2053 (Rhinehart, 2019). This vast difference in wealth along racial lines is the racial wealth gap.

Racist laws and discrimination have created the racial wealth gap. Housing, employment, and educational policies have disadvantaged Black people. Black people inherit less wealth and have lower incomes, lower levels of homeownership, and lower rates of health insurance than white people (Gold, 2020; “Reducing the racial homeownership gap”, n.d.). These factors have made it harder to build wealth and left Black people more vulnerable to financial struggles (Jan, 2018). This all leads to the big gap between white and Black wealth.

Wealthy, white households also add to this problem. Upper-middle-class and wealthy families stay wealthy by passing down their wealth from generation to generation, they also use their privilege and connections to help their kids personally and professionally. These families often fight against policies that lead to greater societal equity (Reeves, 2017). In families that have the top 20% of wealth in the U.S., 57% of kids remain in that range for the rest of their lives. Rich kids tend to become rich adults. On the other hand, fewer than 15% of people born into the bottom 20% of families with wealth ever make it to the top 40% (Pfeffer, 2015). 72% of households in the top 20% are white. Combined, Black and Latino households make up only 16% of this top bracket of wealth (Joo & Reeves, 2017). Therefore, more white families have the resources to ensure their kids are wealthy too. (Check out this game to see how wealthy families stay wealthy.)

What can be done?

Addressing this issue requires changes in state and national policies on a range of topics. Some examples are changing current laws, such as strengthening and enforcing the Fair Housing Act of 1968, expanding health care coverage, and implementing a corporate financial transaction tax to fund a risk insurance program to protect against housing market crashes which deeply affect Black communities. New policies like student loan forgiveness or creating a Minority Business Advocacy office could encourage financial equality (“Policy agenda to close the racial wealth gap”, 2016). Reparations are also a crucial step toward reducing the racial wealth gap. Black and Indigenous people have been prevented from building wealth for hundreds of years while white families were able to attain and grow their assets. To bridge this head start in white wealth, reparations are necessary. These are just a few of the policies that could ease the racial wealth gap. Check out this article for a review of solutions on this issue.

While these suggestions are big changes, there are smaller actions that can be taken to diminish the gap. If you are someone with inherited wealth, you can redistribute it to people in your community that do not have access to inheritance or give it to an organization that can do that for you. Supporting politicians and policies that address the systemic nature of the racial wealth gap is another great choice. Investing in Black-owned businesses, cooperatives, and organizations working towards financial equity is another option. These steps are important in order to address how the racial wealth gap shows up in your community and are needed alongside wide-sweeping policies aimed to reduce the gap on a national level.

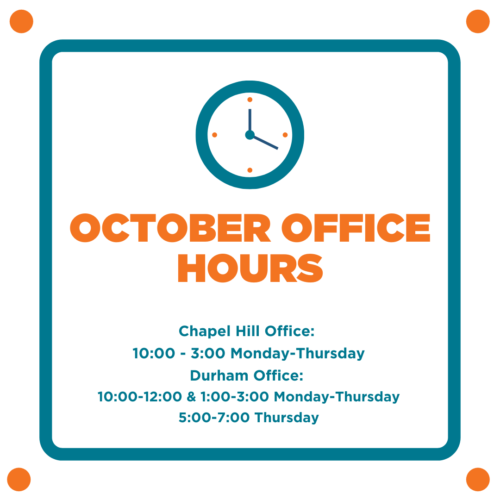

What is CEF doing about the racial wealth gap?

CEF works to address the racial wealth gap in three specific ways:

- Offering non-predatory financial services and products. This includes 65 financial coaching modules that Members can access to support financial goals from budgeting to purchasing a home and CEF’s Safe Savings Accounts which are aimed to make banking more accessible and rewarding. Members receive a match of 15% when they meet their savings goal and are never charged a fee for participating, saving Members $40,000 over their lifetime (Fellowes & Mabanta, 2008).

- CEF actively works to ensure Members are safely housed. The Housing First model is guided by the belief that basic needs, like food and a place to live, need to be met before someone can successfully address less critical needs, such as employment, budgeting, or addressing substance abuse. Due to COVID-19 and increased financial instability, CEF started a Housing Assistance Fund for Durham-based Members. This fund supports Members who were unable to access assistance through other avenues, to ensure that they can be stably housed. Funding was provided by community members who choose to redirect stimulus checks to ensure that people in financial need had access to that support. Providing an avenue for people who benefit from the racial wealth gap to directly support people who are negatively impacted by the racial wealth gap is an essential part of CEF’s work.

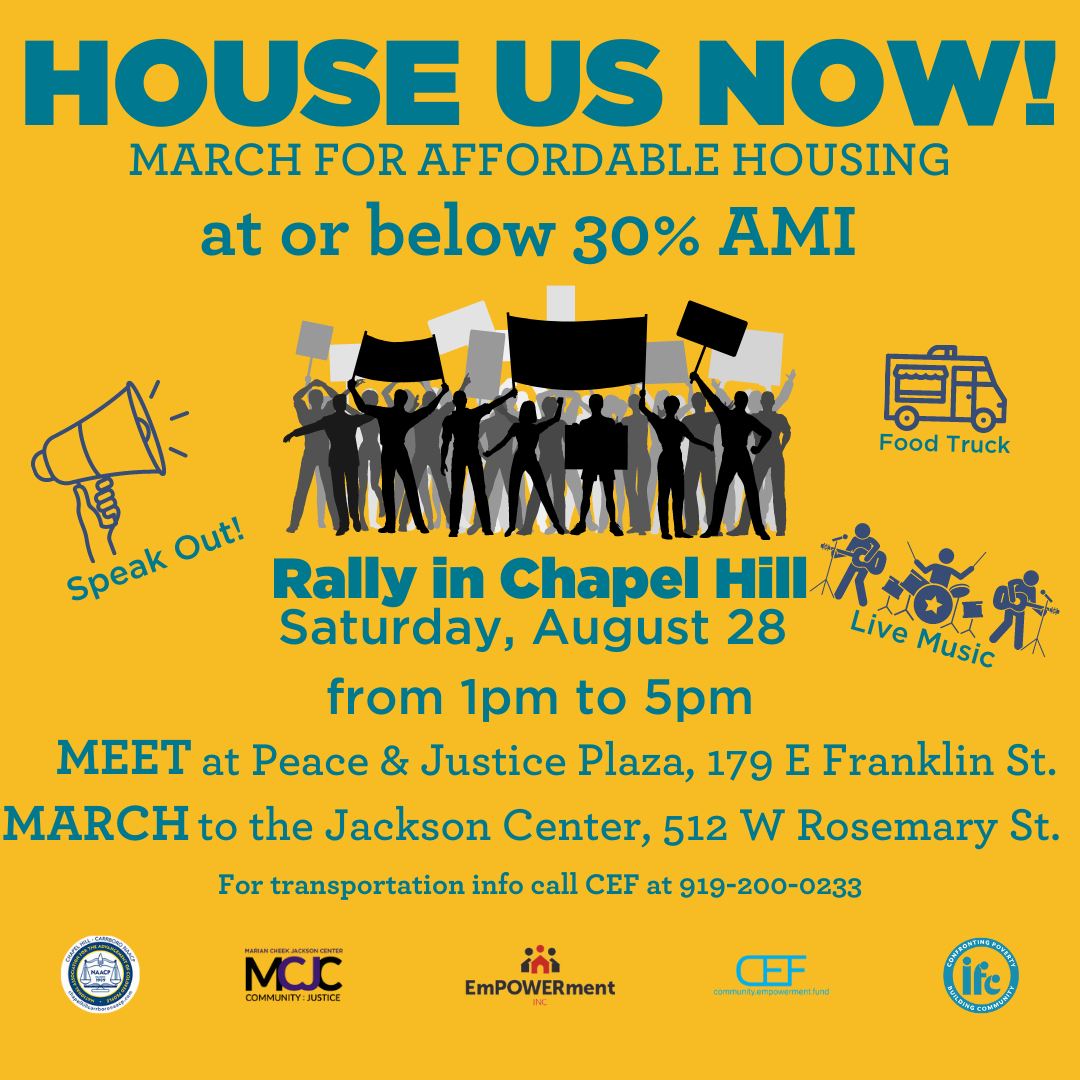

- CEF Members are actively engaged in advocacy work. Community and Office Organizers Rosa Green and Yvette Matthews guide this work, creating spaces for Members to talk about and to advocate on behalf of their own interests. Having platforms for community members to share their voices and offer solutions is essential if we are going to create systems that are truly equitable.

*In general, CEF uses APA grammar rules in our writing. The APA says that the names of race and ethnic identities should be capitalized, as they are proper nouns. CEF is intentionally leaving “white” (when referring to a racial identity) lower-cased. We recognize that by capitalizing words we are giving them power and we do not want to encourage white power in any way. Unlike the AP’s explanation for why they are choosing to lower-case “white” we want to be clear that we believe white people do have a shared experience–that is one of privilege. We also believe that undoing racism is the responsibility of white people and worry that implying that white people do not have a shared experience (as the AP does) is a dangerous tactic that is aimed at discounting the responsibility that white people have in undoing racism and white supremacist culture. Ultimately, we know that race is a construct but that racial differences are not. They are real and need to be addressed directly. For any questions or clarifications around CEF’s choice of words please contact ari rosenberg (arir[at]communityef.org).

Adams, K., & Brancaccio, D. (2020 August 7). The economy reimagined, Part 1: Dealing with inequality. Marketplace. https://www.marketplace.org/2020/08/07/the-economy-reimagined-part-1-dealing-with-inequality/

Cilluffo, A., & Kochhar, R. (2017, November 1). How wealth inequality has changed in the U.S. since the Great Recession, by race, ethnicity and income. Pew Research Center. https://www.pewresearch.org/fact-tank/2017/11/01/how-wealth-inequality-has-changed-in-the-u-s-since-the-great-recession-by-race-ethnicity-and-income/

Fellowes, M. & Mabanta, M. (2008, January 22). Banking on Wealth: America’s New Retail Banking Infrastructure and Its Wealth-Building Potential. Brookings. https://www.brookings.edu/research/banking-on-wealth-americas-new-retail-banking-infrastructure-and-its-wealth-building-potential/

Gold, H. (2020, July 15). Opinion: The racial wealth gap is at the heart of America’s inequality. MarketWatch. https://www.marketwatch.com/story/the-racial-wealth-gap-is-at-the-heart-of-americas-inequality-2020-07-15

Jan, T. (2018, March 28). Redlining was banned 50 years ago. It’s still hurting minorities today. Washington Post. https://www.washingtonpost.com/news/wonk/wp/2018/03/28/redlining-was-banned-50-years-ago-its-still-hurting-minorities-today/

Joo, N. & Reeves, R. (2017, October 4). White, still: The American upper middle class. Brookings. https://www.brookings.edu/blog/social-mobility-memos/2017/10/04/white-still-the-american-upper-middle-class/

Pfeffer, F. (2015). Rising wealth inequality: Causes, consequences, and potential responses. University of Michigan. https://poverty.umich.edu/research-projects/policy-briefs/rising-wealth-inequality-causes-consequences-and-potential-responses/

Policy agenda to close the racial wealth gap. (2016, September). Center for Global Policy Solutions. http://globalpolicysolutions.org/report/policy-agenda-close-racial-wealth-gap/

Reducing the racial homeownership gap. (n.d.). Urban Institute. https://www.urban.org/policy-centers/housing-finance-policy-center/projects/reducing-racial-homeownership-gap

Reeves, R. (2017, June 13). Dream hoarders: How the American upper middle class is leaving everyone else in the dust, why that is a problem, and what to do about it. Brookings Institution Press. https://www.brookings.edu/book/dream-hoarders/

Rhinehart, C. (2019, July 12). African American wealth may fall to zero by 2053. Black Enterprise. https://www.blackenterprise.com/african-american-wealth-zero-2053/ Sivy, M. (2012, November 20). Why so many Americans don’t have bank accounts. Time. https://business.time.com/2012/11/20/why-so-many-americans-dont-have-bank-accounts/